Freelancing has become a popular career choice for many people, offering flexibility, independence, and the opportunity to work on diverse and exciting projects. However, one of the biggest challenges freelancers face is managing their finances. Without a regular paycheck or employer to handle things like tax withholdings, retirement contributions, and health benefits, freelancers must take on these responsibilities themselves.

One tool that can greatly simplify financial planning for freelancers is a Free check stub maker. While it may seem like a small detail, having the ability to generate professional check stubs for your freelance income can help you track earnings, stay organized, and plan for the future. In this blog, we’ll explore how a check stub maker can simplify financial planning for freelancers, and why it’s a tool you shouldn’t overlook.

What is a Check Stub Maker?

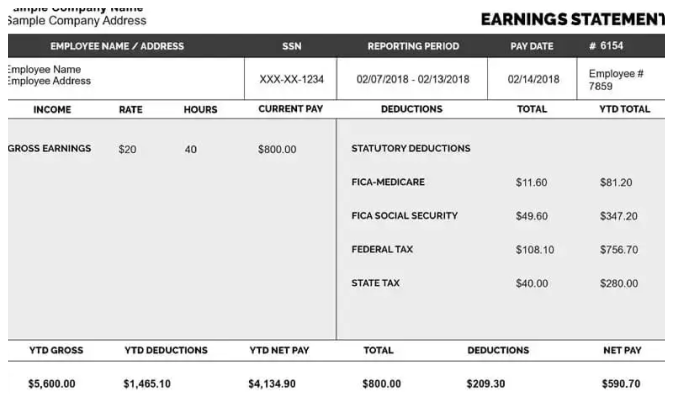

Before we dive into the benefits of a check stub maker, let’s first understand what it is. A check stub maker is an online tool that allows you to generate pay stubs (or check stubs) for freelance work. These stubs typically include details such as:

- The amount earned

- Deductions (taxes, insurance, etc.)

- The net pay or take-home amount

- The period worked (weekly, bi-weekly, monthly, etc.)

Freelancers typically don’t receive traditional paychecks from an employer, but using a check stub maker can help you create a professional-looking record of your earnings and deductions. This is particularly helpful when it comes to organizing your finances, staying on top of tax responsibilities, and planning for both short-term and long-term goals.

Why Freelancers Need to Focus on Financial Planning

Freelancers are responsible for managing every aspect of their business. This includes not only delivering great work but also managing their finances, setting aside money for taxes, saving for retirement, and ensuring they are paid on time. Financial planning as a freelancer can be tricky because:

- Income is often unpredictable, and you may not know exactly how much you’ll make each month.

- Freelancers are responsible for their taxes, which can be complicated without the right tools or knowledge.

- Freelancers don’t typically receive benefits, such as health insurance or retirement plans, from an employer.

- Managing cash flow can be difficult, especially when you’re juggling multiple clients or working on projects that take time to pay out.

Despite these challenges, effective financial planning is essential for long-term success as a freelancer. And a check stub maker can be a key tool in helping you stay on top of your financial responsibilities.

How a Check Stub Maker Can Help Simplify Financial Planning for Freelancers

Now that we understand the importance of financial planning for freelancers, let’s explore the specific ways in which a check stub maker can simplify the process.

1. Tracking Earnings and Income Consistently

One of the biggest challenges for freelancers is tracking their income, especially when it comes from multiple sources or clients. A check stub maker can help by providing a professional record of every payment you receive. This helps you stay organized and ensures that you’re always aware of how much you’ve earned.

Each time you receive payment from a client, you can generate a check stub using the maker. The stub will list important details, including the date of payment, the amount earned, and any deductions or taxes. This makes it much easier to track your total earnings over time and ensures that you never lose track of a payment.

Having this kind of organized record also allows you to identify trends in your income, such as which months you earn more or less. This helps you predict future earnings and plan accordingly.

2. Simplifying Tax Preparation

Taxes are one of the most complicated aspects of freelancing. Freelancers are responsible for paying their self-employment taxes, including Social Security and Medicare taxes, and they must report all their income to the IRS. Many freelancers struggle with the challenge of setting aside enough money for taxes throughout the year and ensuring they file their taxes accurately.

A check stub maker simplifies tax preparation in several ways:

- Clear Record of Earnings: Every check stub you create shows exactly how much you’ve earned. When it comes time to file your taxes, you’ll have a clear record of your income, which makes it easier to calculate your tax obligations.

- Deductions and Withholdings: Many check stub makers allow you to input deductions such as taxes, health insurance, or retirement contributions. This helps you see how much of your income is being set aside for taxes or other expenses, so you can plan accordingly.

- Accurate Reporting: Since you’re using a check stub maker to keep track of your income and deductions, you’ll have all the information you need to file your taxes accurately. This reduces the risk of errors and helps you avoid penalties from the IRS.

In short, a check stub maker makes the tax process much easier and less stressful, helping you stay on top of your responsibilities as a freelancer.

3. Managing Cash Flow Effectively

Cash flow management is one of the most important aspects of freelancing. Since your income isn’t guaranteed and may fluctuate from month to month, it’s essential to keep track of payments and plan your spending carefully. A check stub maker can help you manage cash flow by providing a detailed record of your earnings.

Here’s how a check stub maker helps with cash flow management:

- Tracking Due Payments: When you create check stubs for each payment you receive, you’ll have a clear record of when each payment was made and how much you earned. This helps you stay on top of your accounts receivable and avoid missing payments from clients.

- Predicting Income: By reviewing your check stubs, you can get a better sense of how much you’re earning on a monthly or quarterly basis. This allows you to predict your income more accurately and plan for leaner months when your income might be lower.

- Avoiding Overspending: When you track your income closely, you’ll be better equipped to budget your money and avoid overspending. For example, if you know that you’re going to have a slow month, you can plan and cut back on non-essential spending.

4. Building a Strong Financial Foundation for the Future

Freelancers don’t always have the luxury of employer-sponsored retirement plans or health benefits. As a freelancer, it’s your responsibility to plan for your future, including saving for retirement, building an emergency fund, and securing health insurance.

A check stub maker helps you build a solid financial foundation by keeping track of your earnings and providing a clear picture of your financial situation. With this information, you can:

- Save for Retirement: Knowing how much you earn each month helps you set aside a portion of your income for retirement. Many freelancers open individual retirement accounts (IRAs) or contribute to other retirement savings plans, and a check stub maker makes it easier to calculate how much you should save.

- Create an Emergency Fund: Life is unpredictable, and freelancers must be prepared for unexpected expenses. By tracking your income with a check stub maker, you can set a realistic savings goal for your emergency fund and ensure that you have money set aside for tough times.

- Secure Health Insurance: As a freelancer, you’ll need to find your health insurance coverage. Knowing how much you’re earning makes it easier to determine how much you can afford to pay for health insurance each month.

5. Improving Professionalism and Client Trust

In addition to helping you with financial planning, a check stub maker can also improve your professionalism and build trust with your clients. When you generate professional-looking check stubs, you present yourself as organized and serious about your business. Clients appreciate this level of professionalism, which can lead to stronger relationships and more business opportunities.

A check stub maker can also help you track payments from clients, ensuring that you’re paid on time and that there are no disputes over how much you’re owed. This level of transparency and organization can go a long way in building trust with clients, which is essential for long-term success as a freelancer.

How to Use a Check Stub Maker Effectively

Here’s a simple guide on how to use a check stub maker to simplify your financial planning:

- Choose a Reliable Tool: Select a check stub maker that suits your needs. Look for one that allows you to customize your check stubs, input deductions, and track multiple clients.

- Create Check Stubs for Each Payment: After each payment, generate a check stub detailing your earnings and deductions. This will help you keep an accurate record of your income.

- Review Your Financial Situation Regularly: Use your check stubs to track your earnings over time. Regularly reviewing your financial situation will help you identify trends and plan for the future.

- Use Check Stubs for Tax Preparation: At tax time, use the information from your check stubs to calculate your total earnings and deductions. This will make filing your taxes much easier and more accurate.

Conclusion

Freelancing offers a great deal of freedom and flexibility, but it also comes with its own set of financial challenges. Managing your finances as a freelancer can be complicated, especially when it comes to tracking income, paying taxes, and planning for the future.

A check stub maker is a simple yet powerful tool that can help you stay organized, manage cash flow, and ensure that your financial planning is on track. By using a check stub maker, you can take control of your finances, simplify tax preparation, and build a strong financial foundation for the future. Whether you’re a new freelancer or an experienced one, a check stub maker is a must-have tool for simplifying your financial life.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season