Microfinance bank loans have become the most innovative tool for people in need and small enterprises that are deprived of the traditional ways of banking. It is the most effective alternative for low-income members to elevate their economic status and gain financial freedom. If you need a step-by-step guide from scratch on how to apply for a microfinance loan, then this is for you.

What is Microfinance?

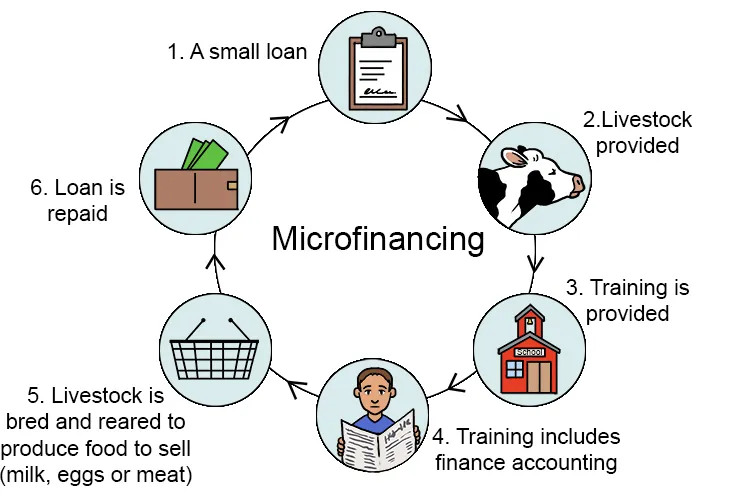

A prior understanding of what microfinance is comes before the stages. Generally, microfinance can be described as a whole range of financial services spanning loans, savings, insurance, and training provided to people or small-scale businesses not accessing mainstream banking services. Microfinance targets economically depressed populations and makes it possible for them to improve their lifestyle.

Step 1: Determine Your Financial Needs

First, clearly define why you need the microfinance loan. Now that you have determined what you want to use the loan for, it is important to estimate how much you would need. Remember that the microfinance institutions lend a relatively modest amount, so apply for an amount that would be suitable for your case.

Step 2: Locate Microfinance Institutions

They can obtain microfinance loans through specialized microfinance banks, NGOs, cooperatives, among others. Research the local/country institutions offering loans in your region. Rank the potential lenders based on interest rates and their repayment terms and application processes.

- Comparison of interest rates: Most microfinance institutions have institutions that charge very low interest rates; hence, one is to shop for the most favorable interest rate and terms of repayment.

- Terms loans: Ensure that the terms presented are known and clear.

- Check customer reviews: Get insights into other borrowers’ views to help decide whether the institution can be trusted.

Step 3: Gather Required Documentation

Although a microfinance institution is less demanding than other more institutionalized lenders, you will still have to produce information, which might include:

- ID that proves your identity (national ID card or even your passport)

- Proof of residency, such as a utility bill or rent agreement

- Proof of income or a business plan explaining how you intend to use the loan and how you will repay it.

It is more probable that your loan application is approved if you are requesting a business loan but you design a simple business plan which states exactly what you intend to do with the loan and your goals and prospects for customers and profit projections.

Step 4: Apply

Having your documents in order and a particular microfinance institution in mind, you would need to submit your application. The procedures vary with place, but this is what you should expect to find in general, such as;

- Application form: Fill all the personal and financial details, the purpose for which you intend to borrow the loan, and how much you intend to borrow.

- Attach necessary documents: Attach documents which have on them your identity card, proof of income, among others depending on the documents the bank requires.

- Get to the loan officer: Several microfinance institutions request that you meet a loan officer who will discuss your application, the terms of the loan, and your repayment plan. The same provides an opportunity for inquiries regarding the loaning procedure.

- Wait for Approval: You shall wait for them to review your application. They will give you an approval if everything in it is correctly filled.

Step 5: Getting the Loan and Distribution Process

After loan approval, microfinance institutions will process the amount in cash directly to your bank account or any other offered method there is-by mobile wallets, cash, etc. It is very important to know the kind of distribution you can get because this can significantly influence how long it takes you to receive the loans.

As part of their services, many microfinance institutions provide training or counseling to their borrowers to enable them to use the credit wisely and efficiently. For a novice borrower, this would be very helpful at first.

Step 6: Repayment Plan and Schedule

Normally, the payback periods of the microfinance loans are shorter compared to the traditional loans disbursed by the banks, and fall within the six months to two years range. In most cases during the application process, especially when discussing with a loan officer, the pay back schedule will be set in accordance with the financial conditions. This includes payments spread over a week, every other week, or monthly based on the pay back terms agreed upon.

- Follow the plan: This will ensure you stick to the repayment schedule so as to avoid any penalty. This also helps keep the relationship good with an institution.

- Track payments: Most of the institutions will provide fairly easy tools that may include mobile applications or even paper receipts, so one can track the person’s repayments.

Step 7: Use the Loan Wisely

Apply it with proper purpose. That way, if you’re using it for funding a new venture or paying for other personal expenses, it will be guaranteed to be repaid with comfort and in due time.

- Invest prudently: That is, if it’s a business loan, ensure the money goes directly to the business, for example, to inventory, marketing, or equipment.

- Track your progress: You should keep track of the usage of your loan periodically and what it is bringing in terms of income or growth.

Conclusion

This microfinance loan is one of the best sources available for those who have no access to mainstream banking. It’s no lifeline but a pretty effective tool for the promotion of economic growth through an improvement in the lives of micro-entrepreneurs and the low-income population. You can consider getting a microfinance loan from JS Bank for a seamless process.